START BLOG

Stay In-The-Know

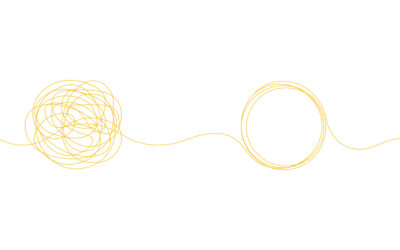

The Start Health HSA Investment Guide

While 401(k)s and IRAs offer tax-free contributions and growth, they lack tax-free distributions. Roth IRAs provide tax-free growth and withdrawals but not tax-free contributions. Flexible Spending Accounts (FSAs) offer tax benefits for medical expenses but are employer-owned and subject to a “use-it-or-lose-it” rule. HSAs stand out because they provide tax-free contributions, growth, and withdrawals, are fully owned by you, and roll over every year with no expiration. Plus, HSAs can be invested to accelerate growth. Start Health even offers in-house investment resources to help members prepare for the future.

Wave Goodbye to Surprise Bills

Wave Goodbye to Surprise Bills! The Start Health cash-pay reimbursement model is a champion of price transparency. In an era where medical bills often come with layers of confusion, hidden fees, and unexpected charges, paying cash for healthcare services offers a...

From Confusion to Clarity: How a Cash-Pay Model Simplifies Healthcare

From Confusion to Clarity: How a Cash-Pay Model Simplifies Healthcare The complexities of traditional health insurance often lead to frustration, unexpected expenses, and bureaucratic delays. For many, paying for medical care with cash offers a simpler, more...

The Unicorn: Start Health is an HSA-Eligible Indemnity Plan

Start Health: The HSA-Eligible Indemnity Plan Those who are familiar with Health Savings Accounts (HSAs) know that the main qualifying factor is a high-deductible health plan. Those with employer-sponsored, high-deductible plans benefit significantly from their HSAs,...

What is Fixed Indemnity Health Coverage?

What is Fixed Indemnity Health Coverage? Fixed indemnity health coverage like Start Health is a type of insurance plan that provides a predetermined, fixed payout for specific medical services, regardless of the actual cost incurred. Unlike traditional health...

Super Savings: Paying Cash for Healthcare

How Paying Cash Upfront Can Save You Money in Healthcare Healthcare costs in the United States can be notoriously expensive, often leaving patients with sticker shock when the bills arrive. While insurance is a common way to mitigate these costs, paying cash upfront...