Your Partner in Delivering an Affordable Healthcare Plan

Become appointed to gain access to a cutting-edge product with competitive commissions. Start Health offers lower premiums and comprehensive coverage in HSA-qualified plans.

A More Transparent Alternative to Traditional Health Insurance

- No Network Restrictions or Surprise Bills

- Low-cost Fixed Reimbursement Model

- Cash-Price Provider Discounts

- HSA Qualified

Materials Downloads

Download these helpful materials to help your clients understand how Start Health insurance works.

Learn How Start Health Works

Learn everything you need to know about Start Health with this quick, comprehensive training video. Designed specifically for brokers, this video covers how Start Health works, its unique benefits, and answers to the most common questions. Gain the knowledge you need to confidently present Start Health to your clients and offer them a flexible, affordable alternative to traditional health insurance.

Who We Serve

Start Health is ideal for Utah Individuals who don’t qualify for significant subsidies through the marketplace and want to lower healthcare costs without compromising coverage. For example:

- Doctors

- Dentists

- CPAs

- Financial Planners

- Independent Contractors

- Fractional Executives

- Realtors

- Self-Employed Individuals

- Small Business Owners

- Individuals Offered ICHRA Coverage by an Employer

What Brokers Are Saying About Start Health

Broker FAQs

Who Are Ideal Candidates for Start Health Coverage?

Start Health is ideal for those who don’t qualify for significant subsidies through the marketplace and want to lower healthcare costs without compromising coverage. For example:

- Doctors

- Dentists

- CPAs

- Financial Planners

- Independent Contractors

- Fractional Executives

- Realtors

- Self-Employed Individuals

- Small Business Owners

- Individuals Offered ICHRA Coverage by an Employer

What is a "Reimbursement Model"?

Start Health members pay a monthly premium for coverage. When visiting a provider, they pay upfront using their Start Benefit Card or another payment method. By paying cash for eligible services, members often receive a discounted rate. When members submit an itemized receipt to their member portal, the Start Reimbursement Rate is applied to the deductible. Once the deductible is met, the reimbursement amount is credited directly to the policy holder.

What Could Disqualify a Potential Member From a Start Health Plan?

Any affirmative response (“Yes”) to the preceding questions will result in the applicant being deemed ineligible for qualification.

Any tobacco use in the past 12 months?

Are you currently pregnant or have reason to suspect you might be pregnant?

In the past 24 months, have you been recommended to have, or been scheduled for, diagnostic testing, treatment, or surgery that has not been completed?

Within the past 24 months, have you had a health related condition for which you have not sought medical advice or treatment?

Within the past five years, have you received any abnormal test results, medical or surgical treatment, healthcare professional consultation, or prescribed medication for any of the following conditions?

Please indicate ALL that apply:

- Arthritis, Rheumatologic disorder or any disease or disorder of the joints, bones, muscles or back. (Indicate if any condition that has lasted more than one month or that you have been prescribed anything other than over the counter pain relievers.)

- AIDS or tested positive for HIV

- Asthma, Emphysema, COPD, TB, or any other disease or disorder of the respiratory system

- Cardiovascular disease or disorder of the heart, arteries, blood vessels, or blood. (Indicate for any condition for which you were treated with any procedure or prescribed a medication other than statins.)

- Cancer or tumor

- Chemical dependency, drug or alcohol abuse, or any other mental health disease or disorder

- Crohn’s disease, ulcerative colitis, hepatitis, or any other disorder of the liver, stomach, colon, or intestines. (Indicate for any condition for which you received a treatment or prescribed a medication other than over the counter medications.)

- Diabetes or any other pancreas disorder

- Immune system disease or disorder

- Kidney disease or disorder

- Brain or nervous/neurological system disorder

- Stroke

How Are Start Health Plans HSA Qualified?

Start Health plans are HSA-qualified because they meet the IRS and DOI requirements for a High Deductible Health Plan (HDHP). Our plans have high deductibles and cover preventive care 100% before the deductible is met. While Start Health plans don’t have a traditional maximum out-of-pocket limit, once the deductible is met, Start Health reimburses 100% of eligible healthcare costs at our set reimbursement rate. This structure ensures members are protected from large out-of-pocket expenses, allowing our plans to be considered comprehensive coverage and HSA-compatible.

Can Reimbursements Go Back Into My HSA?

Start HSAs are uniquely built as a ‘dual-purse’ account; meaning, the Start HSA card is connected to your HSA AND a regular debit account. All reimbursements must go to the debit account so they aren’t considered an HSA contribution. Start Health members can choose to use those funds to contribute to their HSA if they haven’t met their annual contribution limit.

What Happens If I Don’t Have Enough Money to Pay Up Front?

Each HSA is given a $2k daily credit to cover basic procedure/medical charges. If a larger covered procedure is being considered, members can call Start Health to pre-approve the reimbursement rate to the card on a case-by-case basis.

Does Start Health Cover Prescription Medications?

Yes, Start Health has set reimbursement rates based on medicare rates for generic prescription medications.

Does Start Health Cover Alternative Modalities?

Yes, Start Health has set reimbursement rates for some alternative modalities like Chiropractic Procedures, Osteopathic Manipulative Treatment, Physical Therapy, Allergy Testing, and more.

Start Health does not reimburse for other forms of alternative treatment like acupressure, acupuncture, aroma therapy, hypnotism, massage therapy, and rolfing.

Does Start Health Cover Expenses Associated With Pregnancy and Birth?

Yes, Start Health provides set reimbursement rates for pregnancy and birth-related care. However, if a member is pregnant at the time of renewal, they won’t be eligible to renew their plan, as pregnancy is considered a disqualifying condition. Members due to deliver after their Start Health coverage expires can switch to an ACA plan or another alternative.

If My Client Can't Renew Will They Be Eligible to Switch to an ACA Plan?

Yes, ineligibility for renewal is considered a Loss of Coverage event, allowing clients to sign up for an ACA plan.

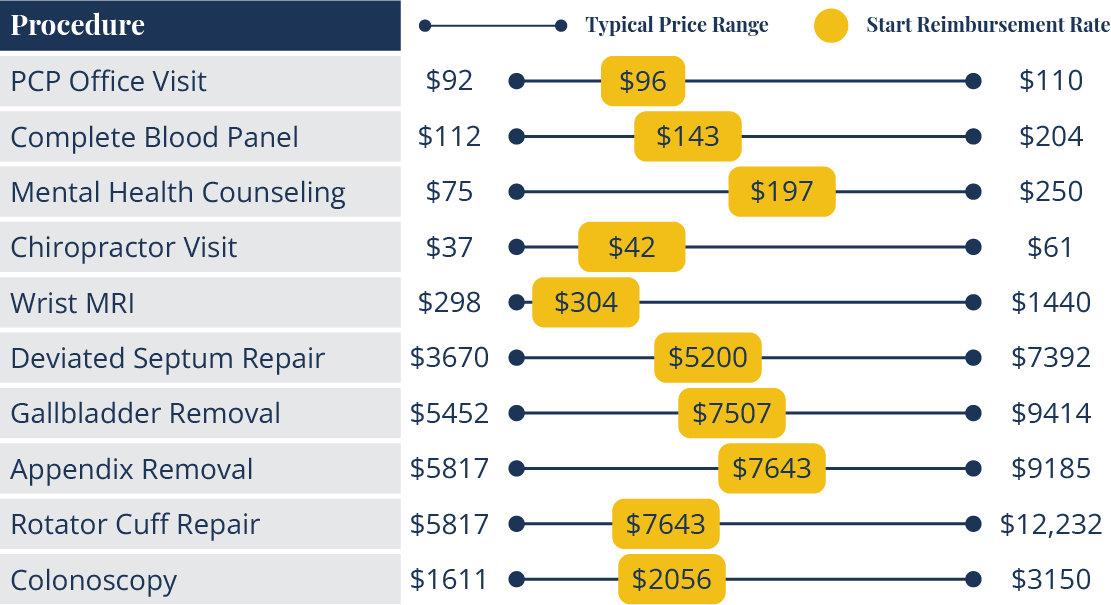

How Does Start Health Determine Reimbursement Rates?

Start Health reimbursement rates are set at 110-130% of medicare rates.

What’s the Typical Length of Stay in a Hospital?

The typical length of a hospital stay depends on the reason for hospitalization, the severity of the illness or condition, and the type of care required. However, in general:

1. For a routine illness or surgery, the average hospital stay might range from 2 to 5 days. For example:

◦ Elective surgeries (such as a hip replacement or gallbladder removal) may require a stay of 2 to 3 days.

◦ Childbirth typically results in a stay of 2 to 4 days for a vaginal delivery and longer (4 to 6 days) for a cesarean section.

2. For more serious conditions (like heart attacks, strokes, or severe infections), the stay might range from 5 to 14 days, depending on the complexity and recovery needs.

3. Intensive care (ICU) stays are typically much shorter, often lasting only a few days (usually 1 to 5 days), but can extend longer for patients with severe injuries or life-threatening conditions.

Hospital stays are typically getting shorter due to improvements in medical technology, better outpatient care options, and an increased focus on reducing hospital costs. However, some patients may require longer stays if they have complications or require additional therapies and rehabilitation.

Overall, the “typical” stay varies greatly depending on the patient’s medical condition and how quickly they are able to recover.

Reimbursement Rate Examples

See how Start Health is helping real people save on premiums and get the best care for the best price.

Join Our Mission in Solving

the High Cost of Healthcare

SEND US THESE FORMS TO GET STARTED

After we process your paperwork, you will receive an email from member@starthealth.com confirming your appointment. It may appear in your spam folder. You can avoid this by adding member@starthealth.com to your contacts.

Email: sales@starthealth.com

Sales: 385-454-3847