Start HSA Guide

Health Is Wealth

Start Health is the only reimbursement model offering the unmatched benefits of an HSA, providing you with excellent coverage and the ability to save and grow tax-free health savings for current and future medical costs.

How Do I Qualify for an HSA?

Qualifying for a Health Savings Account (HSA) is straightforward. First, choose a High Deductible Health Plan (HDHP) as your main health insurance. This plan comes with a slightly higher deductible than usual but includes a lower monthly premium. For the tax year 2024, the minimum annual deductible for self-only coverage is $1,400, and for family coverage, it is $2,800. Start Health has HDHP options, allowing you full capability to open an HSA when you choose Start Health has your healthcare coverage.

Be sure you file your taxes independently; being claimed as a dependent by someone else makes you ineligible for an HSA. By following these steps individuals are able to contribute to an HSA, enjoy tax advantages, and use the funds for qualified medical expenses.

Save

Triple Tax Advantage

First, HSA contributions are tax-free. Second, HSA funds earn tax-free interest and investment earnings. Third, payments for medical care using HSA dollars are tax-free. HSAs provide financial flexibility, promote savvy healthcare decision-making, encourage financial growth, and offer tax advantages.

Rollover Funds

Use HSA funds for your medical, dental, vision, prescriptions, and more. HSA funds always belong to you. They never expire, and remain accessible even in the event of a job change or retirement. What if you never need to use your HSA for medical bills? HSAs basically turn into a 401K when you turn 65!

Low Premiums

Qualified HSA plans offer lower premiums, allowing you the potential to save thousands of dollars in “what-if” costs every year. When you put the extra money you saved from having a low premium plan into your HSA you change the “what-if” costs into lifelong savings. Create a MotivHSA account today to start saving.

Spend

HSA Qualified Medical Expenses

You can save an average of 30 percent on qualified medical expenses because of tax savings on contributions. View a list of qualified medical expenses here.

Use Your HSA Card

Using your HSA card for medical expenses allows you to spend tax-free dollars. When using your HSA you can save money while you spend it.

Smart Spending

Spending Tips

Avoiding unnecessary expenses on medical bills is something everyone appreciates. Optimize your spending and reduce costs by utilizing your HSA card. Reach out to us for further information on saving on medical expenses at 800-894-9454.

Quick Tip

Invest

Managed Path

If you prefer, your investments can be automatically selected, managed, and rebalanced in accordance with age, risk profile, and time horizon factors.

Self Directed ETF

Efficiently manage your portfolios by choosing from a pre-selected menu of investment options and opportunities for growth.

Brokerage

Connect with experienced investors for assistance with trading across investment instruments such as stocks, ETFs, and mutual funds.

Invest

Managed Path

If you prefer, your investments can be automatically selected, managed, and rebalanced in accordance with age, risk profile, and time horizon factors.

Self Directed ETF

Efficiently manage your portfolios by choosing from a pre-selected menu of investment options and opportunities for growth.

Brokerage

Connect with experienced investors for assistance with trading across investment instruments such as stocks, ETFs, and mutual funds.

Quick Tip

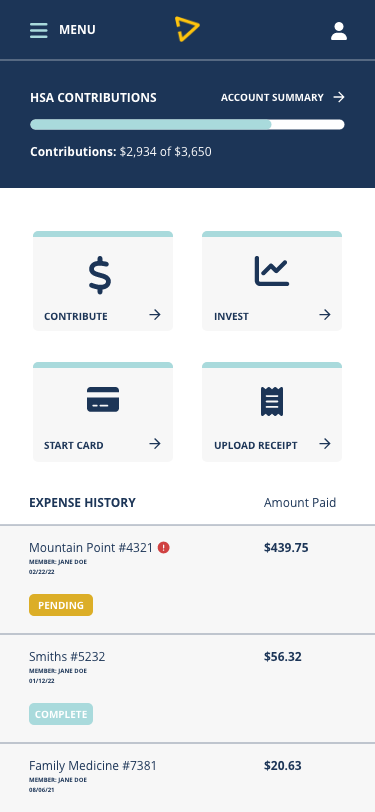

Your HSA, Your Way

The Start Health app make it easy to manage your HSA funds, spending, and investments growth all in one place.

FAQs About HSAs

What is an HSA?

An HSA, or Health Savings Account, is a tax-advantaged savings account used for qualified medical expenses. HSAs are available to those enrolled in a high-deductible health plan, as defined by the IRS, and have yearly maximum contribution limits. HSA funds do not expire and roll over year-over-year, and they are owned by you (not your employer).

How Much Can I Contribute to my HSA?

For 2025, the IRS has set the Health Savings Account (HSA) contribution limits as follows:

- Individual Coverage: $4,300

- Family Coverage: $8,550

What Can I Use My HSA For?

You can use HSA funds for eligible Qualified Medical Expenses (QMEs) only. If you use your HSA funds for non-QMEs, you will be subject to income tax and a 20% IRS penalty for a non-medical withdrawal under the age of 65.

For a list of QMEs, please reference your Start policy.

Can I Have Multiple HSAs

In short, yes. However, you can only contribute up to the IRS limits for a given year. This means that you can contribute up to the IRS limits to one account, or you may choose to spread it across multiple.

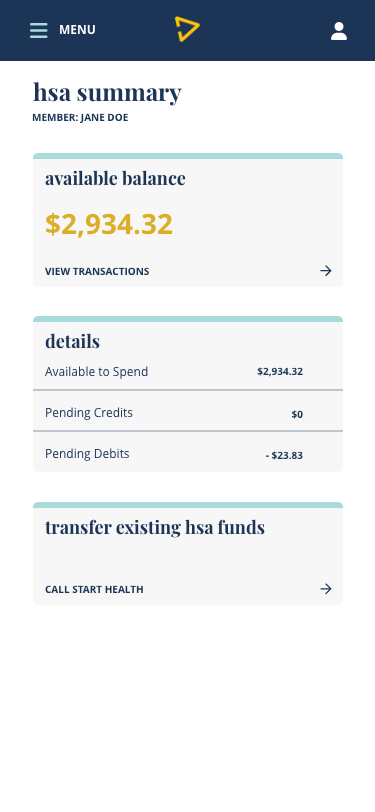

How Do I Access and Use My Start Health HSA Funds?

You can access and manage your Start HSA funds by creating your Start Health account, logging in, and visiting your HSA Summary dashboard. Your dashboard will include:

- Your current HSA balance

- Your expense history

- HSA contributions

- HSA investments

- Start Card management

To use your HSA funds, you may select “Start Health HSA” in your Start Health Card account ordering preferences and simply use your Start Health Card when paying for expenses.

How Do I Invest My HSA Funds?

To invest your HSA funds, you must have a balance of over $2,000. To get started, simply log into your Start Health account, navigate to your HSA summary dashboard and click on the “Invest” tile, then follow the next steps.

Why does my account say MotivHSA?

Your Start Health HSA account is powered by MotivHSA. That is why your HSA portal has a different look than your Start Health Portal.

How do I transfer HSA funds?

Transfer Your HSA in 3 easy steps.

1. Download our transfer form.

2. Fill out the transfer form.

3. Send the form to us at support@starthealth.com

See the rest of our forms and documents here.

Start Saving

Considering an HSA? HSAs are growing in popularity for their ability to make saving for healthcare expenses easy and lower overall healthcare expenses. Enjoy lower premiums, tax advantages, and invest in your future self by opening a Start Health HSA.